10 Easy Facts About Medigap Plan G Shown

What Does Aarp Medicare Supplement Plan F Mean?

Table of ContentsNot known Facts About Boomerbenefits Com ReviewsThe Best Strategy To Use For Hearing Insurance For SeniorsSome Of Boomerbenefits.com ReviewsThe 30-Second Trick For Boomerbenefits.com ReviewsMedigap Plan G - The Facts

They have actually additionally upgraded Justice in Aging's Improper Invoicing Toolkit to incorporate recommendations to the MSNs in its design letters that you can utilize to advocate for customers that have been poorly billed for Medicare-covered services. that will certainly inform carriers when they refine a Medicare case that the person is QMB as well as has no cost-sharing responsibility. These changes were arranged to enter into impact in October 2017, but have actually been postponed. Learn more concerning them in this Justice in Aging Issue Quick on New Methods in Fighting Improper Invoicing for QMBs (Feb. 2017). (by mail), even if they do not likewise obtain Medicaid. The card is the mechanism for healthcare providers to bill the QMB program for the Medicare deductibles as well as co-pays.

Hyperlinks to their webinars and also various other sources is at this web link. Their info includes: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This short article was authored by the Realm Justice.

The 5-Minute Rule for Boomerbenefits.com Reviews

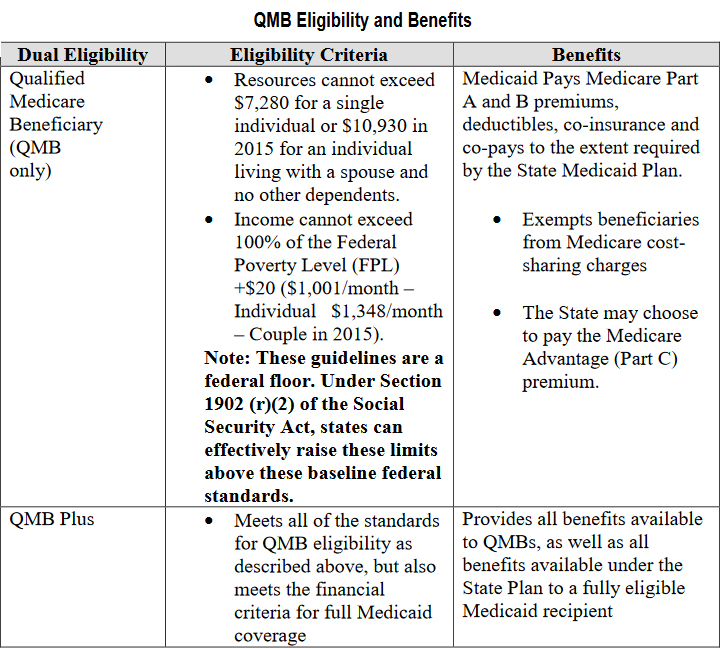

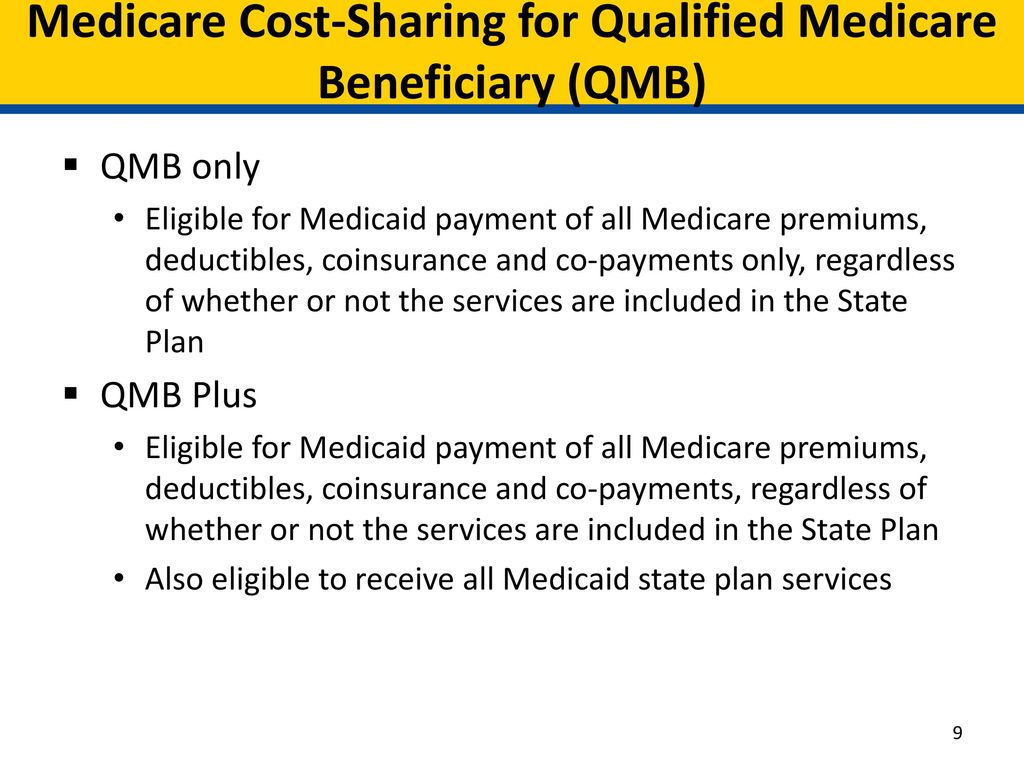

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Any individual who receives the QMB program does not need to spend for Medicare cost-sharing as well as can not be billed by their health care suppliers. If a person is considered a QMB Plus, they fulfill all requirements for the QMB program however also meet all monetary demands to receive complete Medicaid services.

The initial step in enrollment for the QMB program is to discover if you're qualified. A fast and very easy way to do this is to call your local Medicaid office. The next step is to complete an application. You can ask for Medicaid to offer you with an application kind or find a QMB program application from your state online.

There are circumstances in which states may restrict the amount they pay healthcare carriers for Medicare cost-sharing. Also if a state limits the amount they'll pay a supplier, QMB members still do not have to pay Medicare companies for their healthcare expenses and also it's versus the legislation for a company to ask them to pay - medicare supplement plans comparison chart 2021.

A Medicare Benefit Special Needs Plan for dual-eligible people could be a superb alternative. Typically, there is a costs for the strategy, however the Medicaid program will certainly pay that costs (boomerbenefits com reviews). Several people choose this extra coverage due to the fact that it provides regular dental and vision treatment, and also some come with a gym subscription.

More About Plan G Medicare

Enter your postal code to pull strategy options offered in your area. Select which Medicare prepares you would certainly such as to compare in your location. Contrast prices alongside with plans & service providers available in your location. Jagger Esch is the Medicare specialist for Medicare, frequently asked question and also the founder, head of state, and CEO of Elite Insurance Policy Partners as well as Medicare, FAQ.com.

He is featured in numerous publications as well as writes frequently for various other professional columns relating to Medicare.

Several states permit this throughout the year, however others restrict when you can enlist partially A. Keep in mind, Get the facts states make use of various regulations to count your income and possessions to establish if you are qualified for an MSP. Instances of revenue consist of incomes and also Social Safety and security benefits you receive. Examples of assets consist of inspecting accounts as well as stocks.

* Qualified Disabled Functioning Individual (QDWI) is the 4th MSP and also pays for the Medicare Part A costs. To be eligible for QDWI, you have to: Be under age 65 Be functioning however continue to have a disabling problems Have minimal income and possessions As well as, not already be qualified for Medicaid.

Examine This Report about Plan G Medicare

Extra Help covers points like: regular monthly premiumsdeductiblescopays for prescriptions, Some pharmacies might still charge a tiny copay for prescriptions that are covered under Component D. For 2021, this copay disappears than $3. 70 for a common drug as well as $9. 20 for each and every brand-name medicine that is covered. Bonus Aid only relates to Medicare Part D.

Different states may have various ways to determine your earnings and resources. Allow's examine each of the QMB program eligibility requirements in more information below.

The month-to-month earnings limitation for the QMB program increases each year. Source limitations, In enhancement to a regular monthly earnings limitation, there is additionally a source limit for the QMB program.

The Ultimate Guide To Attained Age Vs Issue Age

Like revenue limitations, the source limitations for the QMB program are different depending upon whether you're wed. For 2021, the source limitations for the QMB program are: $7,970 $11,960 Source restrictions likewise boost annually. Just like earnings limits, you should still use for the QMB program if your resources have actually somewhat enhanced.